income tax calculator philippines

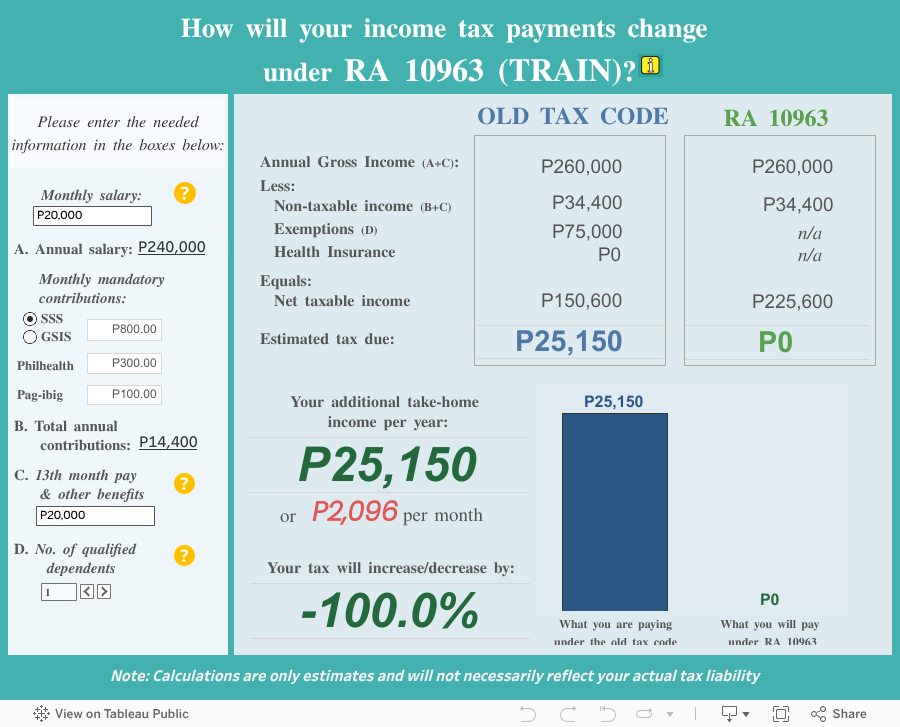

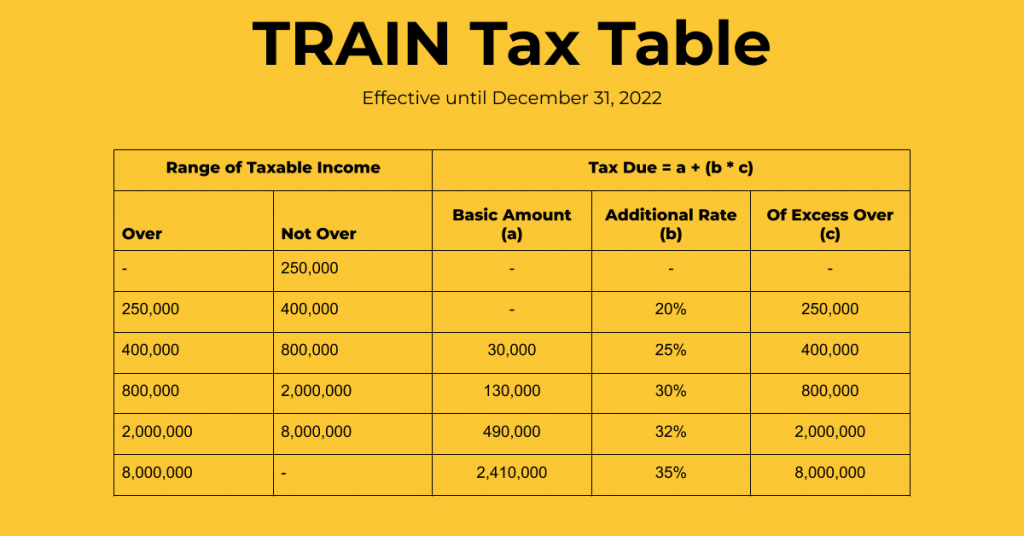

Inputs are the basic salary half of monthly salary deductions other allowances and overtime in hours. Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics.

Tax Calculator Compute Your New Income Tax

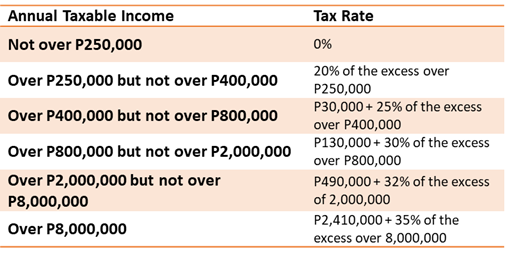

On first 250000.

. Taxumo is the best option for digital tax filing in the Philippines. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2020 and is a great calculator for working out your income tax and salary after tax based on a Annual income. The Philippines Tax Calculator is a diverse tool and we may refer to it as the Philippines wage calculator salary calculator or Philippines salary after tax calculator it is however the same calculator there are simply so many features and uses of the tool Philippines income tax calculator there is another that we refer to the calculator functionally rather than by a.

Review the full instructions for using the Philippines Salary After Tax Calculators which details. On remainder of 352000 at 25. P25000 P58130 P31250 P100.

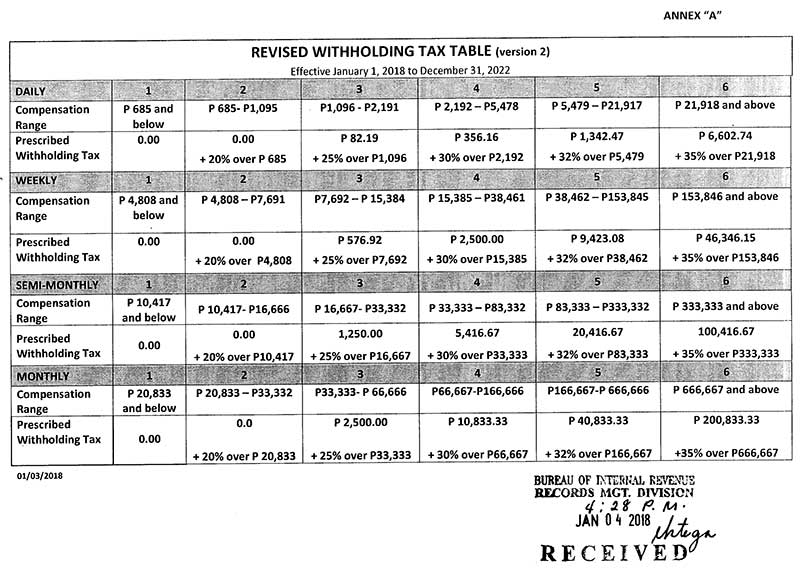

To access Withholding Tax Calculator click here. 6 rows The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35. To estimate the impact of the TRAIN Law on your compensation income click here.

Income Tax 2200245 12 250000 020 12 2640294 250000 020 12 280588 12 Income Tax 23382 All thats left is to subtract your income tax from your taxable income. The Philippines tax calculator assumes this is your annual salary before tax. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8 na buwis sa lahat ng kabayarang siningil ng propsesyunal sa halip na magbayad ng personal income.

The countrys proposed tax reform package under the administration of President Rodrigo Duterte aims to bring down the tax liabilities of most taxpayers in the country. Ad Our Free Tax Calculator Is A Great Way To Learn About Your Tax Situation. This calculator was originally developed in Excel spreadsheet if you wish to get a copy please subscribe to our Youtube channel and.

Heres how it is computed. Using your taxable income compute your income tax by referring. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

The National Tax Research Center NTRC is an agency under the DOF that conducts research in taxation to improve the tax system in the Philippines. Philippines Income Tax Rates and Personal Allowances in 2020 The Income tax rates and personal allowances in Philippines are updated annually with new tax tables published for Resident and Non-resident taxpayers. Husband PHP Wife PHP Gross income.

Net Pay Taxable Income Income Tax 2200245 23382 Net Pay 2176863 Worry About Your Taxes Less with Taxumo. Its online income tax calculator is quite similar in terms of features and functions to the DOF tax calculator except that the former provides more detailed information. Your taxable income will total to an amount of Php 1414875.

Income Tax facts in Phillippines you should know. You must always be sure to go with the best efficient updated and legitimate online tax calculator program. There are now different online tax calculators in the Philippines.

Highlights of the FIRB Accomplishment Report CY 2014. Tax withheld by employer per Form 2316 2 118000 0. Majority of the waged workers who are earning 21000 a month or less will be exempted from tax liabilities while those who are earning more are subject to a.

Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. Taxable Income Php 15000 Php 54500 Php 20625 Php 100 Php 15000 85125 Php 1414875 Refer to the Bureau of Internal Revenue BIR Tax. Here is how it is computed.

Tax Calculator Philippines Description of Calculator. For inquiries or suggestions on the Withholding Tax Calculator you may e-mail contact_usbirgovph. Income Tax Calculator Philippines Who are required to file income tax returns Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens receiving income from sources within and outside Philippines fall under income tax category use this online calculator to calculate your taxable income.

If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Philippines tax calculator and change the Employment Income and Employment Expenses period. The calculator is designed to be used online with mobile desktop and tablet devices. Magnitude of Tax Subsidy Grant and Utilization By Recipient 2006-2015.

Procedures for Availment of Tax Subsidy of GOCCs. This will calculate the semi-monthly withholding tax as well as the take home pay. It is the 1 online tax calculator in the Philippines.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2021 and is a great calculator for working out your income tax and salary after tax based on a Annual income. The Tax tables below include the tax rates thresholds and allowances included in the Philippines Tax Calculator 2020. The calculator is designed to be used online with mobile desktop and tablet devices.

Provision For Income Tax Definition Formula Calculation Examples

How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

Philippines New Tax Law Calculation Of Withholding Tax Steemit

2022 Bir Train Withholding Tax Calculator Calculator

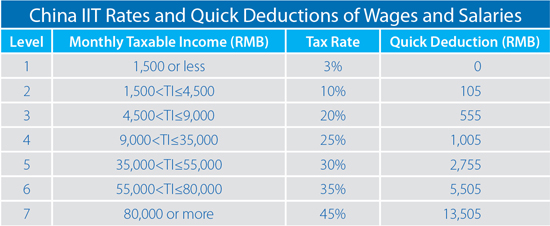

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Excel Formula Income Tax Bracket Calculation Exceljet

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021

Tax Calculator Compute Your New Income Tax

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines

Tax Calculator Philippines 2022

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Calculator Compute Your New Income Tax

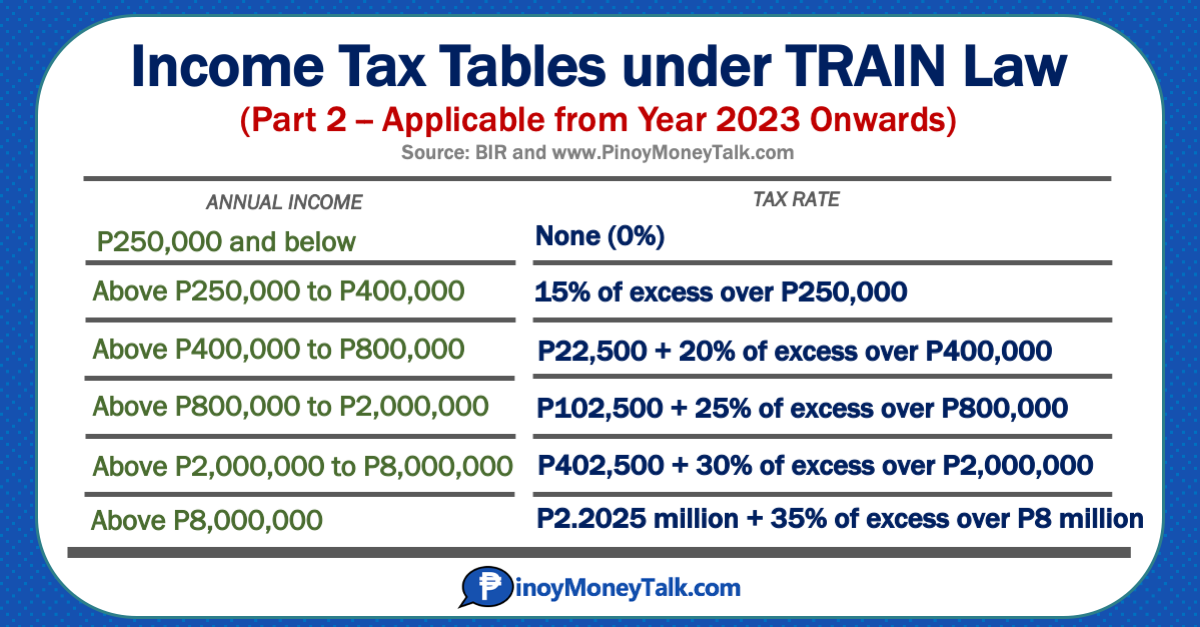

2022 Bir Train Withholding Tax Calculator Tax Tables

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Income Tax Calculation Formula With If Statement In Excel